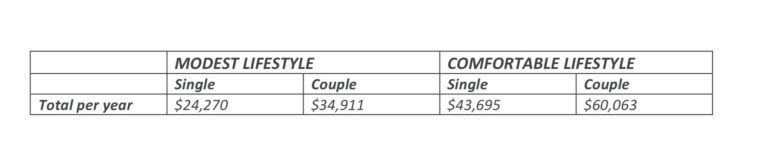

Consolidating multiple super funds into one account.Checking the personalised version of YourSuper comparison tool.Viewing details of your super accounts, including unclaimed or lost funds.Super Funds Tracking for a Comfortable Retirement You can manage your super as a nest egg through the ATO online services by: If you exceed the caps, you may have to pay additional taxes. However, as a rule of thumb, there are limits on the amount of contributions within each financial year. Your spouse may also make contributions to your super account. Transferring funds from foreign super pension accounts.Getting government contributions if you are eligible.Making additional contributions – either concessional contributions or non-conecssional contributions.Salary sacrifice arrangement with your employer.Likewise, you can actively grow your super by means of: Keeping track of your super and determining any lost or withheld super.Reporting any unpaid super from the employer to the ATO (Australian Taxation Office ).Checking your employer’s super guarantee contributions to your account.Get the most out of your employer’s contributions by: These will make a big difference to your financial future one day. Increasing Your Super Account Balance You can grow your super funds based on your personal objectives. The more contributions you make, the more benefit you will receive later on. You can increase your super funds while working for a company with an Australian business number (ABN) for a number of years. How Much Super Grows in Retirement The total lump sum or pension you’ll receive from your superannuation depends on your account balance.įor example, if you are 65 and you have a super balance of $523,000, you are already above the amount needed to support a modest lifestyle based on the estimates of AFSA. Quarterly Super Payment Due Dates Quarter The dates to remember for super contributions are listed below. More importantly, while you’re still earning, take advantage of super contributions from your business endeavours. In addition to the super contributions from your employer, you can also add extra funds to boost your savings. Think long-term by preparing for the future and doing what you can in the present. If you are starting your first job, whether part-time or full-time, you can start planning for the retirement lifestyle you wish to have. Men had 61.2 per cent of total super balances in 2015-16 while women had around 38.7 per cent. Superannuation and account balances are on average higher among men. AgeĪccording to ASFA’s 2017 report, the average super balance in 2013-2014 for men was $292,500 and $138,150 for women. How Much Super You Need Based on Age and Gender To determine the reasonable amount of super you should have in your account, you can look at the following data from ASFA that shows the average super balance by age and gender. For a single person, $545,000 is ideal for a comfortable retirement. The ASFA estimates $70,000 as the amount of money needed in personal savings or super funds for a single person or couple with average living expenses.įor a couple wanting to live comfortably during retirement, ASFA recommends that they have at least $640,000 in their super account. How Much Super Do You Need? According to ASFA, the country’s authority in research and advocacy for the superannuation industry, the age pension would likely be enough for a modest lifestyle. The standard serves as a guide to boosting your superannuation funds to achieve the retirement life that you have imagined. The ASFA (Association of Superannuation Funds of Australia) comfortable retirement standard is also explained.

#Asfa retirement standard calculator how to#

We’ll also discuss how to boost your super balance and set a retirement balance target. This article will teach you how to calculate the super contributions needed to achieve the lifestyle you want after retirement. Understanding the ASFA Retirement Standard.Target Setting on Your Retirement Balance:.Super Funds Tracking for a Comfortable Retirement.How Much Super You Need Based on Age and Gender.How much money will you need for a comfortable retirement lifestyle? It can be difficult to gauge whether your super is on track to provide for your retirement, or if you need to save a bit more money.

0 kommentar(er)

0 kommentar(er)